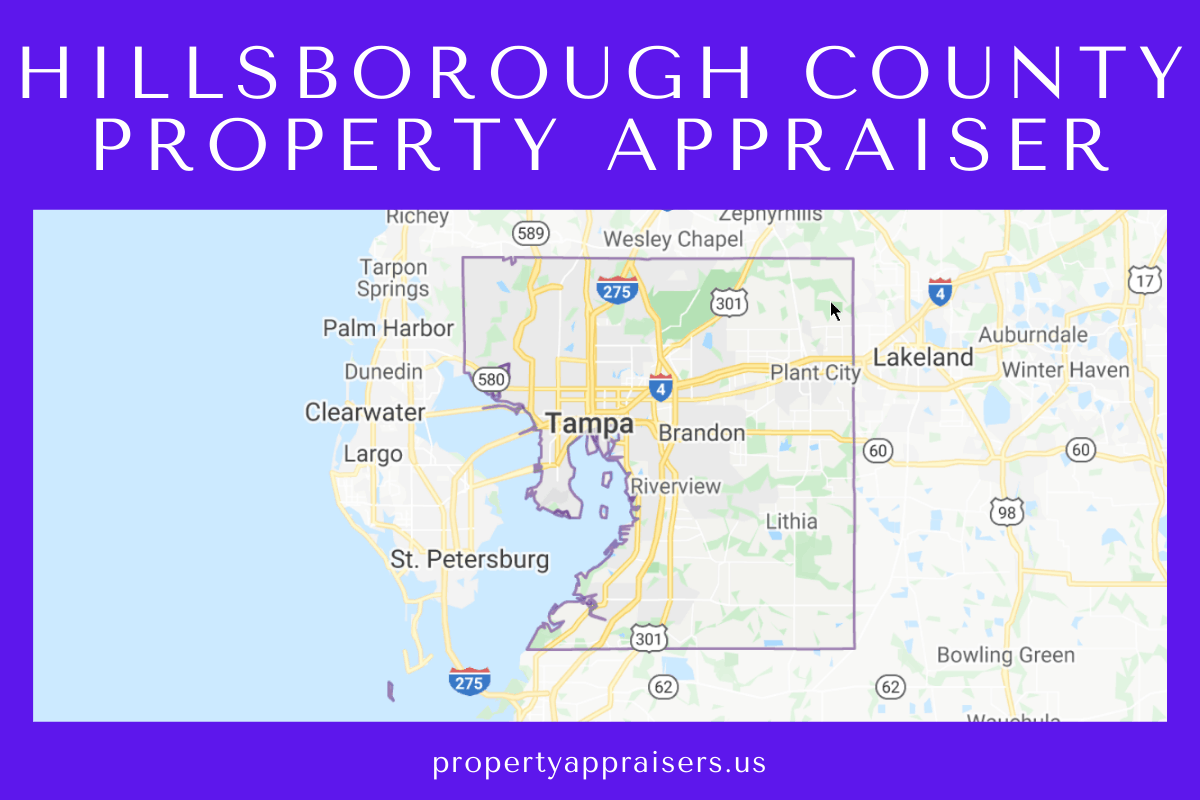

Homestead Exemption Florida Deadline 2020 Hillsborough County

The deadline for 2020 homestead exemption was march 2 2020.

Homestead exemption florida deadline 2020 hillsborough county. Deadline to file for homestead exemption is march 1st of the filing year. When you buy a home in florida you have until march 1st of the year following the purchase to file for homestead exemption. For example if you bought a home in 2019 you ll have until march 1 2020 to file your homestead exemption. Kennedy boulevard tampa fl 33602 4932.

This page will give you a high level overview of what you are going to need to do to file for homestead exemption in florida. The second 25 000 excludes school board taxes and applies to properties with assessed values between 50 000 and 75 000. The following exemptions may also be filed on line along with the new homestead exemption application. You must be a permanent resident of florida residing on the property as your primary residence as of january 1st.

The deadline to submit the application for exemption is march 1st for the year in which you wish to qualify please have these documents available while completing the application. If it falls on a weekend or legal holiday then it would extend to the next business day. Kennedy boulevard tampa florida 33602 4932 open 8 00am 5 00pm monday friday view all our locations. Begin the filing process now the property appraiser s office is currently accepting 2021 applications.

Florida driver license or identification cards. The statutory filing deadline is march 1. Our office location is at 15th floor county center 601 e. The deadline to file a timely application for 2020 is march 2 2020.

This exemption applies to all taxes including school district taxes. Filing for homestead exemption in florida. The first 25 000 of this exemption applies to all taxing authorities. Under florida law failure to file for any exemption by march 2nd constitutes a waiver of the exemption privilege for the 2020.

Our office mails all new homeowners an exemption packet approximately 6 8 weeks after their deed is recorded in the county records. If the march 1st deadline is approaching please come into our office to file in person. Downtown tampa 15th floor county center 601 e. The owner must establish hillsborough county as his her legal domicile reside on the subject property as of january 1 and be a us citizen or permanent resident.

See dates to apply.