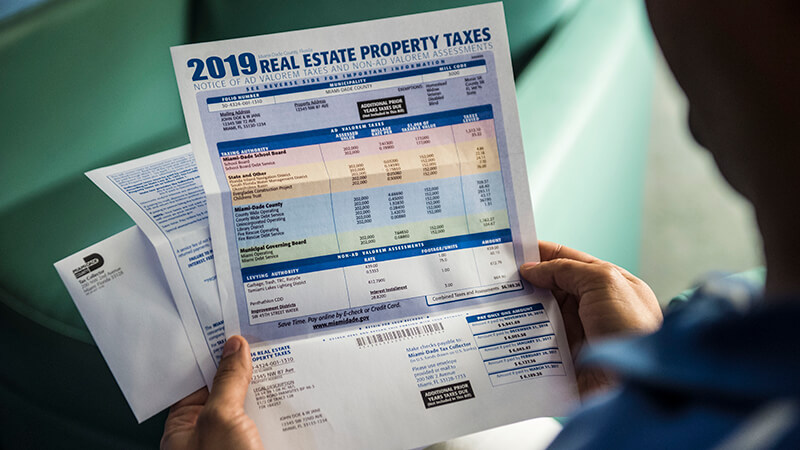

Florida Homestead Exemption Miami Dade

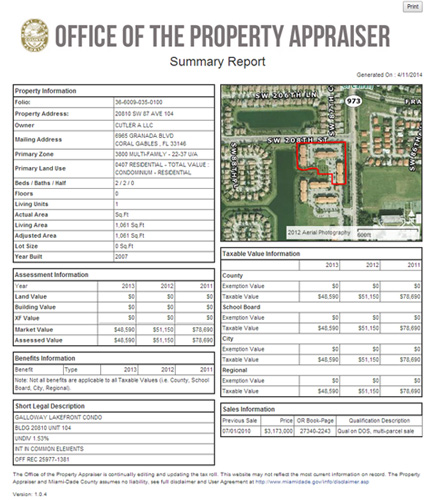

The second 25 000 excludes school board taxes and applies to properties with assessed values greater than 50 000.

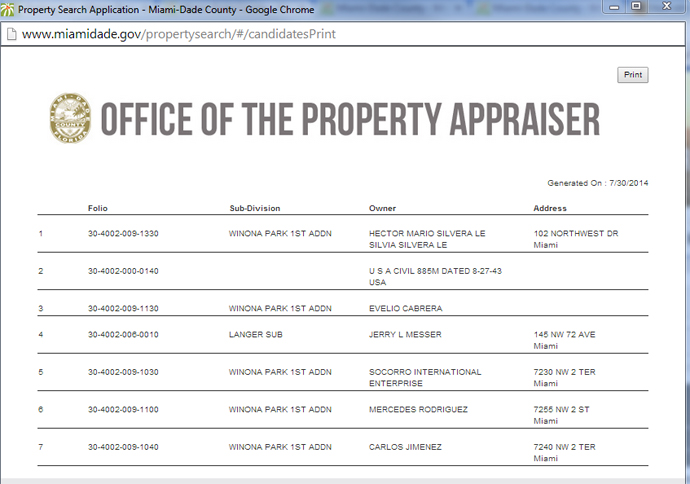

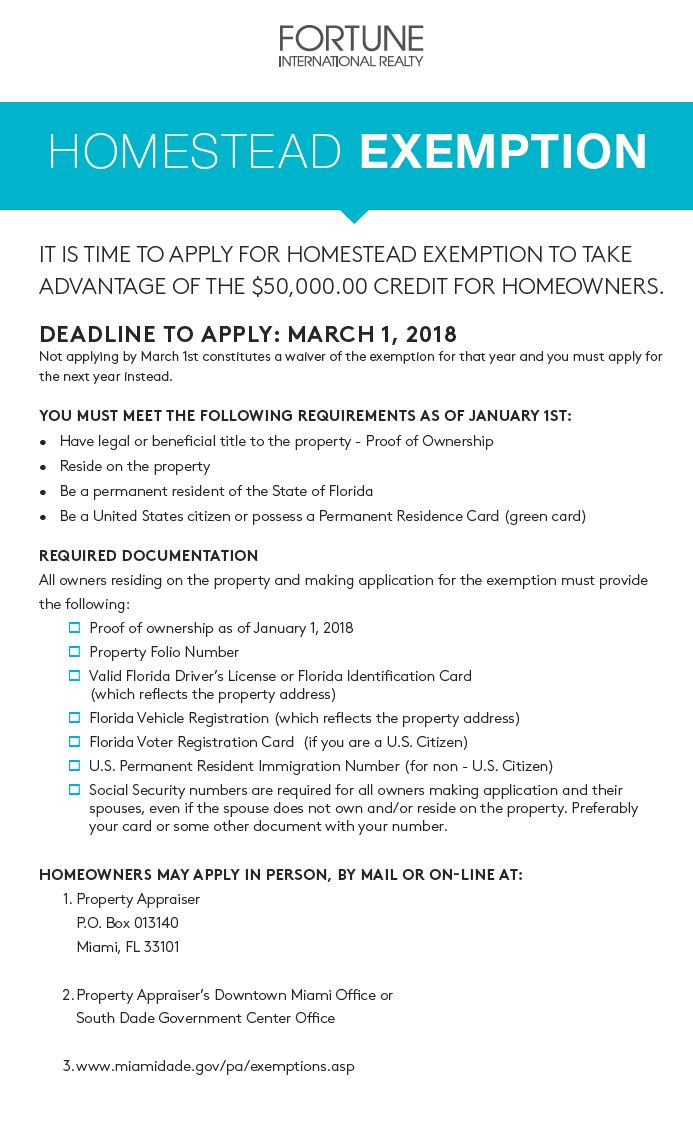

Florida homestead exemption miami dade. The second 25 000 excludes school board taxes and applies to properties with assessed values greater than 50 000. The first 25 000 of this exemption applies to all taxing authorities. Seniors relief fund faqs. The first 25 000 of this exemption applies to all taxing authorities.

Assessed value 85 000 the first 25 000 of value is exempt from all property tax the next 25 000 of value is taxable the third 25 000 of value is exempt from non school taxes and the remaining 10 000 of value is taxable. In december miami dade county mailed 100 checks to senior homeowners who benefited from the additional homestead exemption for persons 65 and older better known as the senior exemption. State law allows florida homeowners to claim up to a 50 000 homestead exemption on their primary residence. The second 25 000 excludes school board taxes and applies to properties with assessed values greater than 50 000.

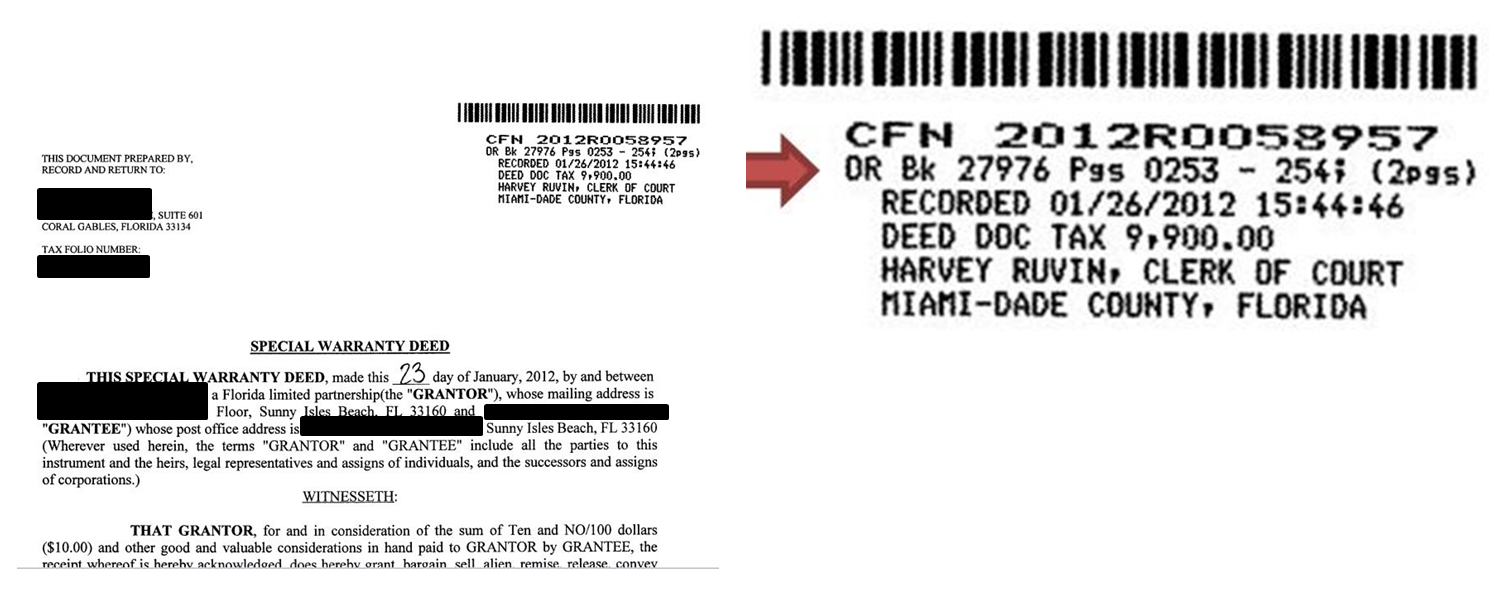

The check is made out to the homeowner who qualified for the senior exemption on january 1st. Filing for the homestead exemption can be done online. The property must qualify for a homestead exemption at least one homeowner must be 65 years old as of january 1 total household adjusted gross income for everyone who lives on the property cannot exceed statutory limits. Filing for the homestead exemption can be done online.

Homeowners may claim up to a 50 000 exemption on their primary residence. Homestead exemption and portability.