Florida Homestead Exemption Application 2020

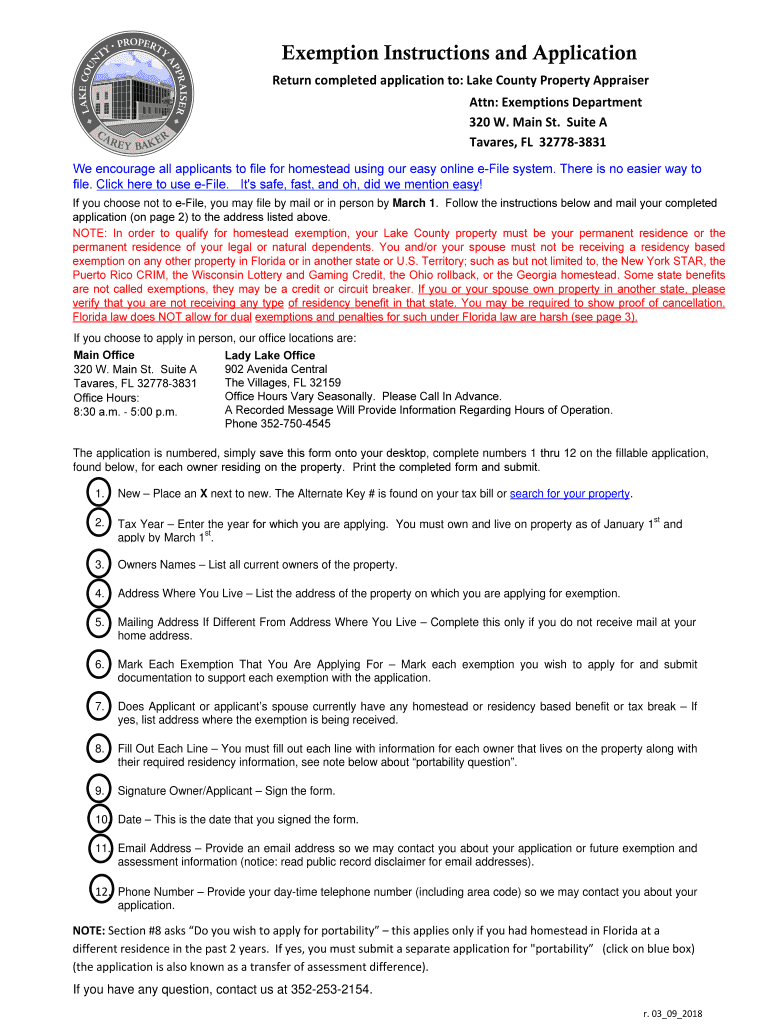

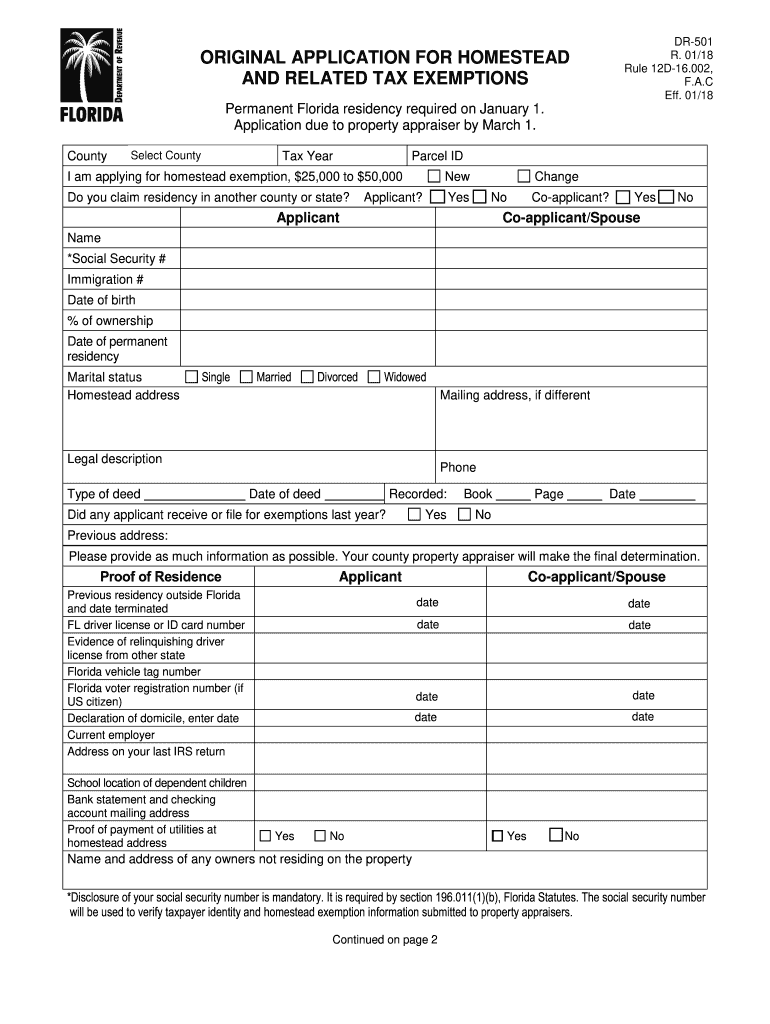

If you purchased a new home or condo in the state of florida and made it your permanent residence prior to january 1 2020 you may file for tax year 2020 homestead and other exemptions until september 18 2020.

Florida homestead exemption application 2020. If you qualify you can reduce the assessed value of your homestead up to 50 000. Homestead exemption step 2 do you own and live in the property for which you are seeking this residence homestead exemption. Residents who bought a home in hernando county during 2020 are reminded that applications for homestead exemption must be submitted to the property appraiser s office by march 1. This page will give you a high level overview of what you are going to need to do to file for homestead exemption in florida.

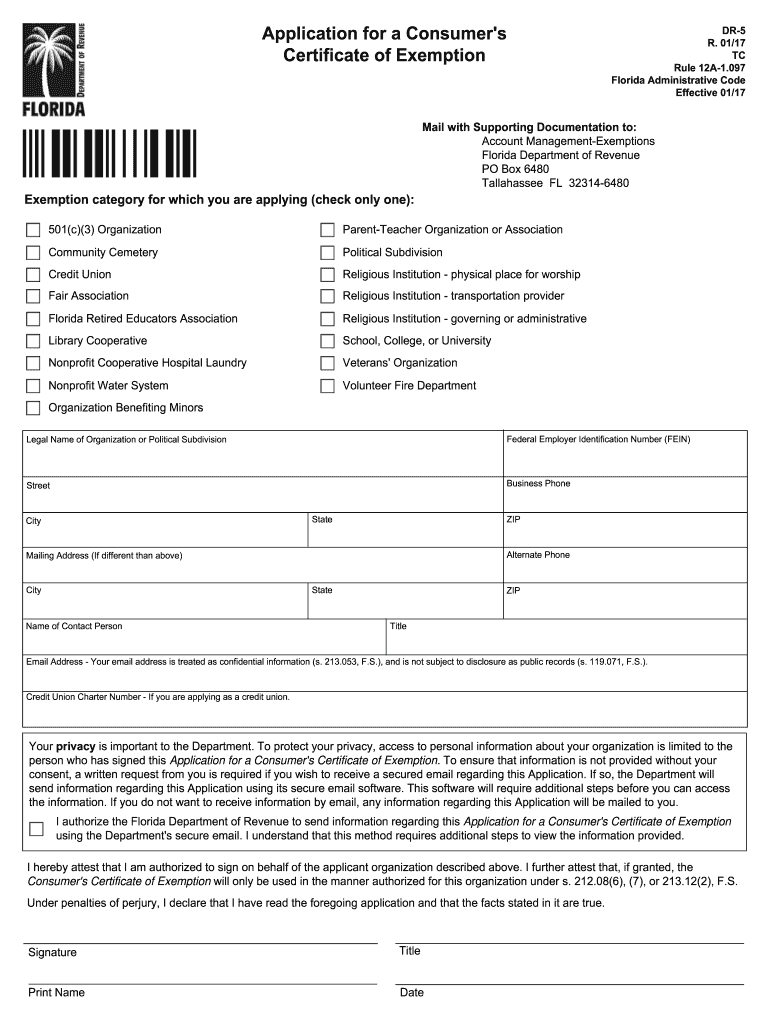

The additional exemption up to 25 000 applies to the assessed value between 50 000 and 75 000 and only to non school taxes. March 22 2020 references approved the homestead exemption in florida can save you hundreds of dollars in property taxes if you are a permanent florida resident. A florida homestead exemption application dr 501 12 14 form is a licit document that allows the residents of florida to apply for homestead exemption on their residential properties. Filing for homestead exemption in florida.

Be it a condominium co op apartment mobile home an open land a part of the individual house. For which the exemption is claimed. Para asistencia en español. Anything that functions have a home as long as it is owned by a single individual.

2020 application for residential. When you buy a home in florida you have until march 1st of the year following the purchase to file for homestead exemption. To qualify for the homestead exemption and the accompanying save our homes assessment cap the home must be the primary and permanent residence. If yes please provide the address of the other property.